If you’ve been thinking about buying a home, one of the questions you are likely asking yourself is this: “Is now the right time, or should I wait?” You might be wondering if the market is too hot to get the house you want right now or maybe you’ve thought it would be better to save for a bigger downpayment. Your instinct tells you to hold off and wait.

But, based on recent Freddie Mac home price and mortgage rate projections, however, waiting to buy a home could possibly cost you more than waiting.

There are three critical ideas to keep in mind before deciding whether to buy now or delay your home purchase for a year or more.

1. Whether home values will be higher

2. Whether mortgage rates will be higher

3. Whether the amount of money you can save while you wait will make a difference in what you can buy.

Let’s dive into each one of these factors so you can make the best decision.

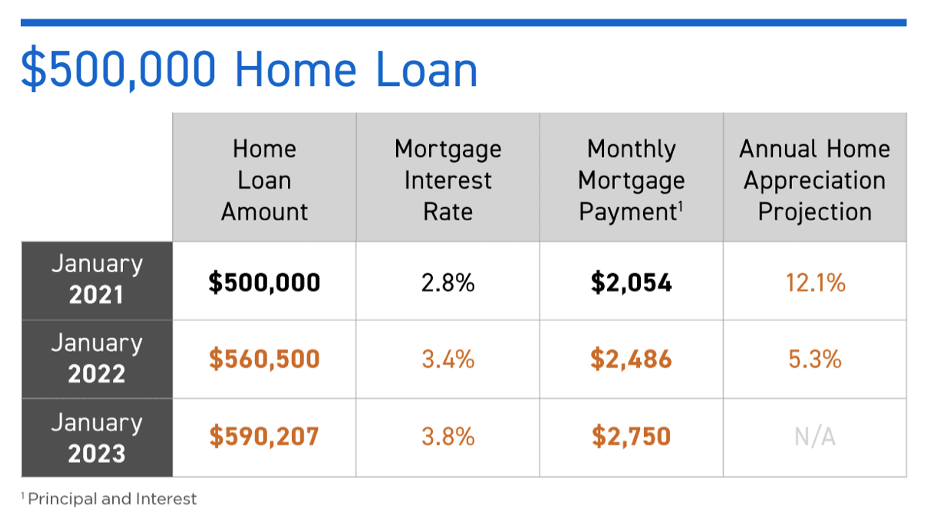

Say you need to take out a $500,000 loan to buy a new home today. With home prices on the rise, that same home could require a $560,000 loan by next year and an almost $600,000 loan the year after that (according to Freddie Mac projections).

When you add in their projections that mortgage rates will only rise from their current historic lows, you can start to get the picture of how waiting will cost you.

Here’s what it could look like:

Source: Freddie Mac, Keeping Current Matters

To boil all that down, your monthly mortgage payment if you make a home purchase today will likely be lower than if you wait a couple of years to buy the same exact house.

Remember, when you’re thinking about home prices, these are very large numbers so even a slight change in your mortgage rate could add up to thousands and even tens of thousands of dollars down the line.

Let’s now explore the idea of waiting to save more money for a downpayment.

Get this—for every $10,000 you save, that only saves you around $50 per month on your mortgage payments. So, unless you can save quite a lot while you wait to buy a home, the extra savings isn’t going to make a huge difference.

Of course, there are other factors to consider. Your location, your income, and your credit score will all have an impact so there is no one cookie-cutter decision that works for everyone. If you need time to get to a higher income level or credit score before you purchase a home, waiting could be right for you.

The general idea to keep in mind is that waiting isn’t always the right answer financially for everyone, even if the market cools and even if you could save more by waiting.

Ultimately, the best time to buy a home is when the timing makes sense for your life. Similar to investing in the stock market, you don’t try to time everything exactly because it’s a long-term investment. But, it doesn’t always make financial sense to wait for things to “calm down.”

If you are trying to decide when is the right time, I’d love to help you with that decision. And, no, my answer is not always buy now. Also, my answer isn’t always the same for every client. My recommendations to each client differ based on that particular client’s financial situation and life plans.

My job isn’t just to help you buy or sell a home.

My goal is to help you make good real estate decisions, so I want to hear from you as you are thinking through things, not just when it’s time to start packing. Reach out to me when you start wondering and daydreaming. I’ll give you all the information I have, listen to what you want to accomplish, and help you come up with a plan that we’ll execute together when you decide the time is right.

Email me and we’ll chat. I can’t wait to hear from you!

Hi, there!

I'm Kristin and my job is to make the process of home buying and selling a home as stress-free and as fun as it deserves to be. I focus on helping clients move into and out of the Langley Pyramid, and beyond. If you're looking for an agent that truly understands your needs and where you are, then look no further. I'm right here!

Contact

703-812-9575 (cell)

11943 Democracy Drive

Reston, VA 20190

kristin.meyer@compass.com

Buy

Weekly updates

Sell

All Articles

LET'S MEET